Makro i sektorske analize koje vam pomažu u pametnom i utemeljenom donošenju odluka.

Zlato do kraja 2026. može i do 5.000 USD/unc

30.12.2025 12:11

Impresivnih +28% povrata za tržišta u razvoju

29.12.2025 17:31

Rast u 2025. otporan ali neujednačen

26.12.2025 11:05

Produktivnost u regiji raste, ali presporo

14.11.2025 18:22

Tromjesečne analize

Tromjesečni outlook i pregledi koji osvjetljavaju najvažnije makro i tržišne trendove i trendove koji pokreću tržište roba.

Ukupno analiza

201

+0 u zadnjih 30 dana

Nedavne analize

0

Objavljeno u zadnjih 7 dana

Najpregledanije

1387

Ukupan broj pregleda

Trendovi

Regija

Najtraženija tema

Filteri

Markets report - Midyear view

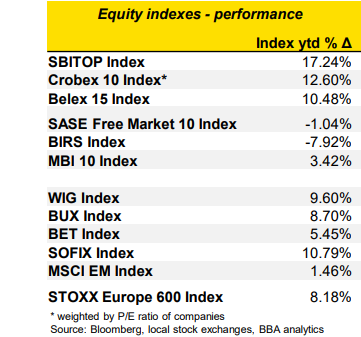

Global equity&bond are in a positive tone in five months of 2023, due to slower inflation and solid company earnings expectations (in main world indices) in next 12M. What is still keeping at least some risk for sporadic corrections present is the remaining need for monetary tightening as well as its magnitude. Equity market in Adria region in the 5M2023 displayed solid performance, except B&H indexes which underperformed. SBITOP, CROBEX10 and BELEX15 outperformed broader benchmark STOXX600.

09.06.2023.

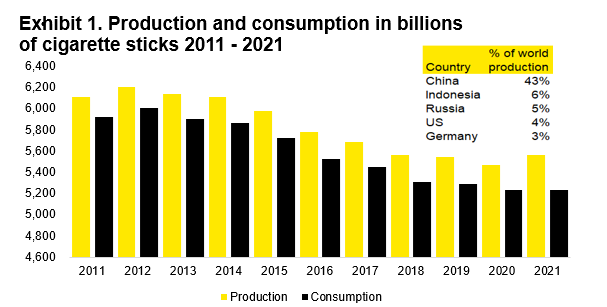

Tobacco industry - Super Filtered profitability performance

In this report we explore the main trends, tailwinds, and headwinds in the regional tobacco industry. We recognize the Adria Region attractiveness for tobacco and divide the main players into two principal subgroups – producers and distributors. We also look at the global picture, examining the performance and strategies of the largest tobacco players.

01.06.2023.

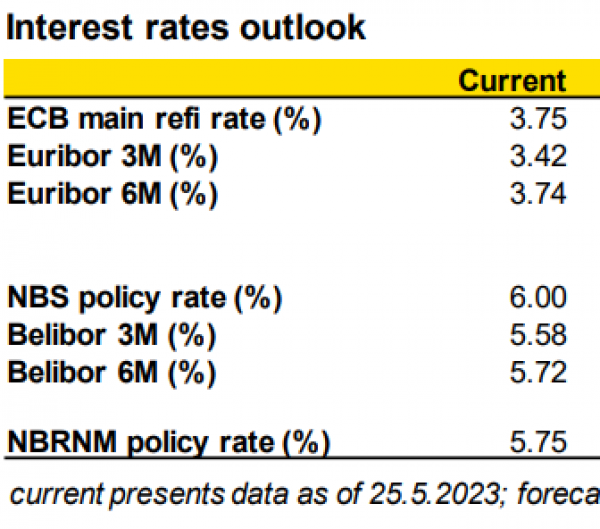

Interest rates outlook - Higher for longer

The 2022 was highlighted by benchmark interest rates moving from extreme lows to high levels not seen in a decade. As inflation rates shows persistence, the policy rates are still biased upwards, and we see them „higher for longer“. The transmission to loan interest rates was, and still is, challenged by ample liquidity in the banking system. Our main thesis is that the ECB will be adjusting policy to keep policy rates in the next years higher than in the past 10 years (even if somewhat lower than currently) alongside gradually squeezing out excess liquidity from the system.

26.05.2023.

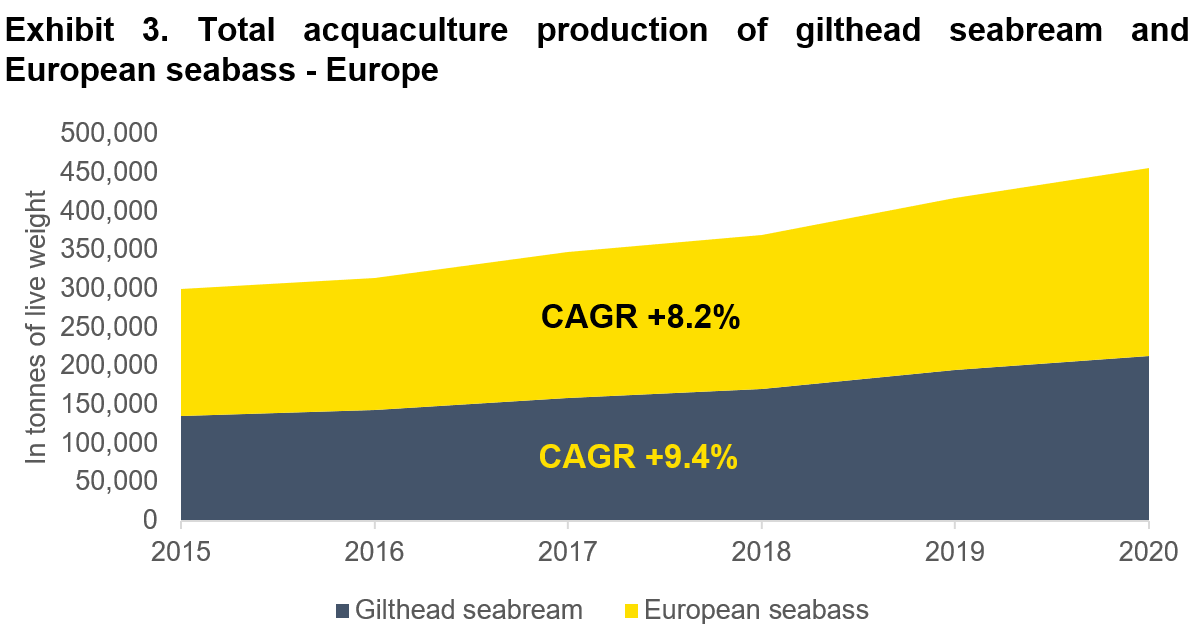

Mariculture industry - Superb nutrition, dreadful economics

Mariculture, the farming of marine organisms, is an emerging industry that is gaining traction in Croatia over the last couple of years. With over 5,800 kilometers of coastline and favorable water conditions, Croatia is becoming a major player in the mariculture sector. This report aims to provide an overview of the current state of the industry in Croatia and its growth prospects for the future.

23.05.2023.

Inflation report - Inflation trending down steadily

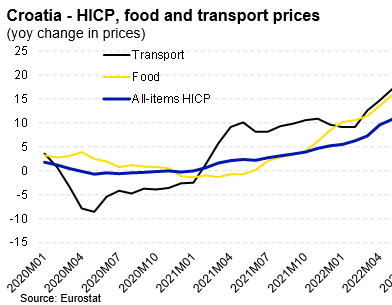

Latest trend in the inflation rates in 2023 showed the continued downshift in headline rates that started in 4Q2022 (in Serbia the peak was seen yet in March). Price pressures eased mostly due to global shift down in energy/commodities prices, while as regard prices of food and non-alcoholic beverages, they still stay stubbornly high (even though on a global level the presented a declining trend).

19.05.2023.

Delivery industry - Delivery on a bumpy road

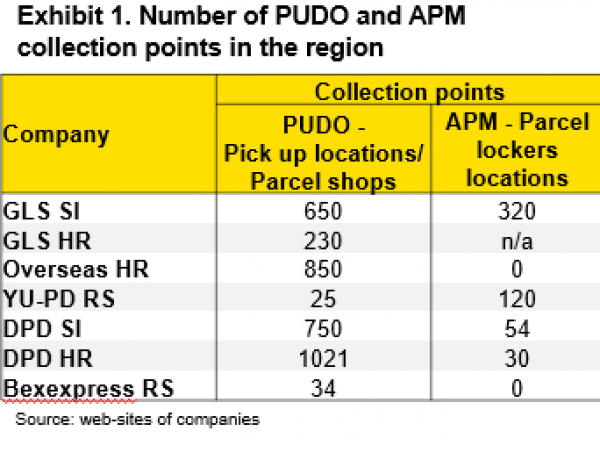

In this report we examine the Courier, Express, Parcel (CEP) industry amid a remarkable growth achieved in previous years and significant transformation of the sector on the back of technological progress and digitalization. With regards to e-commerce segment, OOH (Out-of-home) delivery is the key trend in the industry. The model assumes large network of PUDO (pick-up and drop-off) points and automatic parcel machines, which finally gives flexibility to the customer in collection of parcel.

15.05.2023.

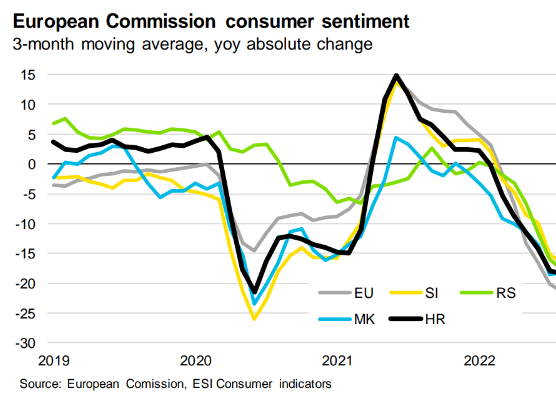

Retail report - Consumer sentiment still in charge

The retail trade in the Adria region at the beginning of 2023 shows mixed picture, with retail in Bosnia and Herzegovina and North Macedonia still growing, stagnating in Croatia, and even declining in Slovenia and Serbia, according to 1Q2023 data.

05.05.2023.

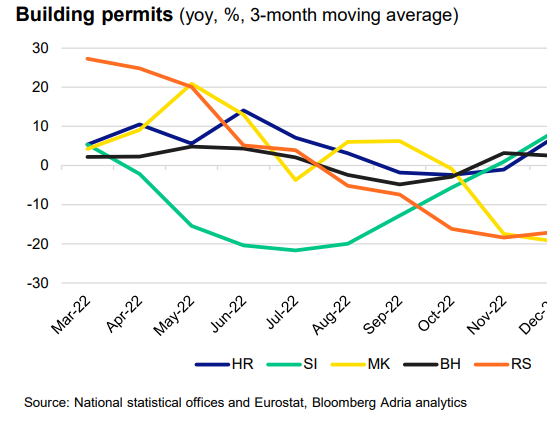

Construction and real estate - Public sector driving construction activity in 2023

In 2023, construction sector is set for a more intensive infrastructure activity, driven by public investments, while activity on buildings is expected to moderate as the residential demand cools down and overall economic activity slows which translates to less private investments.

27.04.2023.